Image source: Pexels

【Game-Time special article, no reproduction without authorization!】

Game-Time report / Starting from last weekend, the news that ByteDance’s gaming business will undergo a large-scale business contraction on Monday has caused a violent shock in the gaming and even the entire Internet circle. ByteDance’s game business, which has taken more than five years and invested tens of billions of dollars, ushered in its “darkest moment” this winter.

After the layoffs began on Monday, various gossips and rumors in the industry continued. For example, the rooftop door of the Byte Building was locked, the conference room was all full that day, and the HR staff of many gaming circle friends immediately went to the downstairs of Byte to “pick up leaks.”

According to the plan, for games that have been launched and are performing well, Zhaoxiguang Annual Conference will seek to divest them while ensuring operations; for projects that have not yet been launched, except for a small number of innovative projects and related technology projects, they will be shut down. Bytedance responded today that it will focus more on the exploration of some innovative games and related technologies. But at the same time, we will also do a good job in the continuous operation of already launched products to fully protect the rights and interests of players.

According to people close to ByteDance, the decision was discussed repeatedly for a long time by business leader Yan Shuo and ByteDance CEO Liang Rubo. Liang Rubo believes that although the game business has achieved certain results, in the past few years, Byte Games has pursued “big and comprehensive” projects, with unfocused projects and scattered resources. It should invest energy and resources into more basic, innovative and imaginative things. project.

Other reports pointed out that behind this decision, Zhang Yiming, the founder of ByteDance and who “doesn’t like playing games” exerted influence.

According to Game-Time, the massive layoffs in ByteDance’s gaming business reflect the continued bankruptcy of the gaming industry’s “grand narrative” of constant “natural and man-made disasters” in recent years, which has triggered a decline in interest in the gaming industry by latecomer technology giants.

The “person” who was most able to challenge Tencent Games

Generally speaking, the growth paths of Bytedance and Tencent are highly similar. Both have concentrated traffic users and continued to focus on the content industry. However, there are differences in their growth paths: Internet advertising was not easy to sell in China in the early years, and Tencent was forced to Entering vertical industries to provide value-added services, and ByteDance started with the most ferocious bidding advertising in the Internet business model, and selectively entered vertical industries in depth.

Toutiao’s personalized recommendations have triggered a highly controversial hot word “algorithm”, and Douyin’s dimensionality reduction attack on the global video industry all reflect ByteDance’s excellence in understanding users. , The enthusiasm and execution ability to explore different fields have also earned ByteDance the nickname “App Factory”.

Byte’s game development also has the shadow of Tencent’s past. It puts the platform first before the product, publishes first and then develops in-house, and first casual before serious.

Game-Time first heard that ByteDance was developing games in 2017, when Douyin established a game content center to test the waters. But it wasn’t until Ohayoo emerged in 2019 and the Zhaoxiguangnian business group was established that ByteDance officially entered the gaming industry.

At that time, ByteDance was regarded as the manufacturer that could best challenge Tencent Games, and its threat to Tencent Games exceeded that of NetEase. Later, the new Big Three structure of “Tengwangmi” was formed, and the frequency of facial recognition decreased in the morning and evening.

There was also a background at the time. According to LatePost, about half of Douyin’s revenue in 2019 was contributed by game advertising. The perception that “games are very profitable” was easily established. From this, Byte followed Tencent Entering the gaming industry is a natural progression.

This is also the first and biggest pitfall that ByteDance has encountered in the gaming business. In the past, ByteDance was accustomed to “bold assumptions, careful verification” to break into new tracks, adopting a highly rational approach of large investments and numerical calculations. method to evaluate feasibility, but as a content industry, games’ requirements for innovative ideas have been underestimated.

When chasing the dream game circle, ByteDance faced such a situation: Tencent occupied half of the entire game market, and the merger of Tencent and NetEase took away more than 70% of the market revenue.

To break this actual “dual rule” market structure, the price to pay must be huge. The method given by ByteDance is to “make miracles with great force”. On the one hand, it builds up a mature team through a large number of mergers and acquisitions, and on the other hand, it starts a “war for people” and takes over the team from other major manufacturers. With the help of Thunder, ByteDance has spread its game business across the country in a short period of time, covering research and development and distribution. The overall number of employees exceeds 2,000, with the highest number exceeding 3,000.

For this, ByteDance paid a huge price. According to statistics from Snow Leopard Finance and Economics, in the four years from 2019 to 2022, Byte made 22 investments in the gaming field, involving 19 companies, with a total amount of approximately 30 billion yuan. Among them, ByteDance acquired Mu Tong with a US$4 billion structure in 2021.

It was also that year that ByteDance reformed its organization and established six major business segments, one of which was Zhaoxiguangnian. This is a sign that the strategic position of the game is highly valued, and it also means that Chaoxi Guangnian is no longer in a state of “no KPI”, but has to bear more revenue and profit indicators.

The story then took a turn for the worse. In 2018, the total number of version numbers began to be regulated, and the number of version numbers decreased year by year, which shocked the industry. Starting from the second half of 2021, the issuance of version numbers was suspended for 8 months, which impacted all domestic game companies. Frequent changes began in the morning and evening. Including the explosive disbandment of 101 Studio, the project “Hua Yishan Heart Moon” was also merged into the distribution department, and other studios such as Oasis Studio and Jiangnan Studio also had projects cut off, etc. Recently, it has been revealed that ByteDance is seeking to sell Mu Tong, which it spent a lot of money to acquire.

Although “Crystal Core” and “Planet: Restart” have proved that Byte Games’ self-research strength has been verified, and an insider revealed that the game business provided “a small part of the growth” for Byte’s rapid revenue growth this year, but for a For companies that have achieved 120 points in other businesses, if the game has achieved 80 points, it is already considered a failure.

The bankruptcy of the gaming industry’s “grand narrative”

For ordinary developers, it is important to make money through games, but it is not mandatory. After being able to support their families and obtain reasonable returns, it is not a bad idea to make a hit and achieve financial freedom.

Giants are different. Giants need grand narratives and promising business potential to “tell stories and grab food and grass.” The market that supports them must be at least trillions in size to be imaginative.

Games have never been the best choice for giants. The outside world needs a hotter and more attractive concept before they are willing to believe it. Therefore, no one will think that Tencent is a pure game company, but will see the value of Tencent games from social networking, e-sports and other aspects.

In recent years, almost every once in a while, new grand narrative themes will appear in games, such as VR, Web3, Metaverse… taking on new forces to promote the rapid growth of games, but judging from the results, their commonality seems to be that without exception Thunder, little rain.

Take VR as an example. As an industry that is being competed for by major international companies such as Google, Sony, and Meta, Newzoo pointed out that the number of active VR hardware device installations worldwide will reach 27.7 million in 2022, of which global VR game revenue will reach 1.8 billion. Dollar. According to the same data from Newzoo, the global game market in 2022 is estimated to be US$196.8 billion, which means that VR games account for less than 1% of the game market, which is still far away from one trillion.

Like VR, Web3 is also a technology representative that is often included in development plans. For example, last year the Shanghai Municipal Government issued the “Shanghai Digital Economic Development “14th Five-Year Plan””, which regarded Web3 as a “new generation network digital infrastructure.”

Web3 is essentially the next generation of the Internet, reshaping online communities in a decentralized manner and stimulating the creativity of democratized communities. In the gaming industry, community-created content replaces developer-created content. This trend has actually been verified in two-dimensional games and party games.

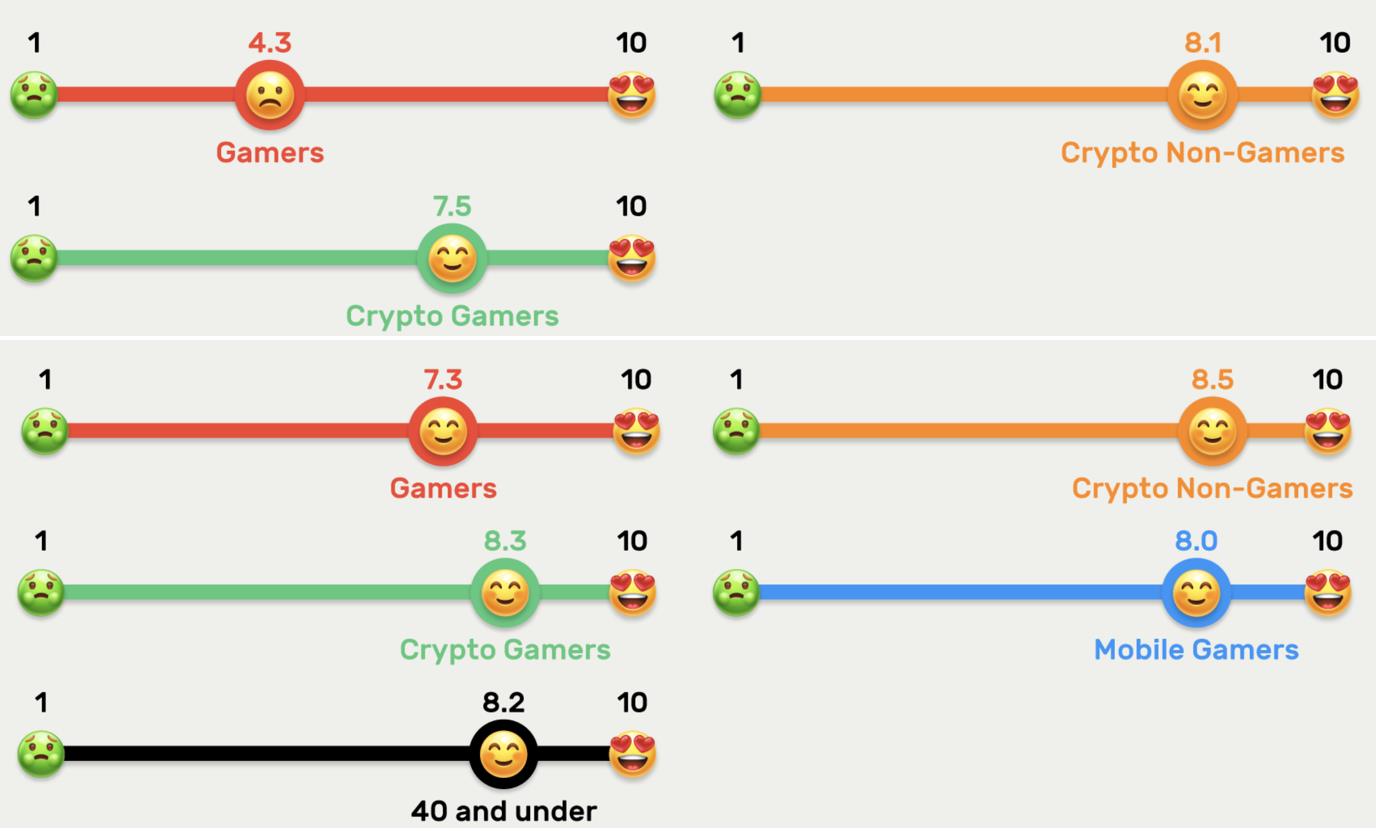

However, due to the deformity of the business models of many Web3 games, which are intended to change players’ motivation to play from pursuing happiness to making money, the development of Web3 has been hindered by frequent thunderstorms. A survey issued by Coda Labs and other institutions shows that although investment in blockchain games has reached US$5 billion in the first half of 2022, 41% of crypto game players are worried about fraud, and the overall impact of Web3 games on players also tends to ” “Disgusted”, that is, it only scored 4.5 points out of 10 points for impact.

Compared with Web3, the public awareness of the Metaverse is much better, thanks to the advocacy of Roblox and Meta. Two years ago, Morgan Stanley even stated in a report to investors that the Metaverse was expected to become a supermarket with an output value of US$8 trillion, which was approximately equal to China’s GDP in the first half of that year.

The specific performance of the Metaverse also far exceeds other grand narratives. Roblox, the “first stock in the Metaverse”, has achieved 66.1 million daily active users in Q1 this year, a record high, and revenue has reached US$660 million, a year-on-year increase of 22%.

The most exciting thing about the Metaverse is the blueprint it depicts. All game developers, players, and devices will be reunited in a virtual world. The imaginative space opened up by the Metaverse has dug a huge pit, covering all the pits that VR, Web3, etc. have dug but not filled before.

Of course, no matter how grand the story is and no matter how long it takes to tell, there must be a time when it can be fulfilled. Once it cannot be realized in time, when the grand narrative goes bankrupt, the gaming industry will also be directly under pressure.

Why has the gaming industry become an industry that is both mature and growing at the same time?

After the epidemic, the global economy has been in turmoil in the past two years. The time spent by Internet users is declining and payment is declining. When the growth of the game industry itself has stopped, and other concepts bundled in the game sector have also found their own way out, the giants’ Strategies were also tested.

Tencent’s approach is to be patient. In Q3 this year, Tencent ended five consecutive quarters of layoffs and started to add employees again.

The difference between Tencent Games and Byte Games is that one game business is a cash cow with its own hematopoietic ability, while the other needs support and blood transfusion from other businesses. Like Tencent, Byte also follows the route of “brothers settling accounts openly” internally. Once Douyin discovers that traffic is more profitable for external games, it will not hesitate to give up on self-developed games, not to mention the live broadcast e-commerce and more Gold’s track.

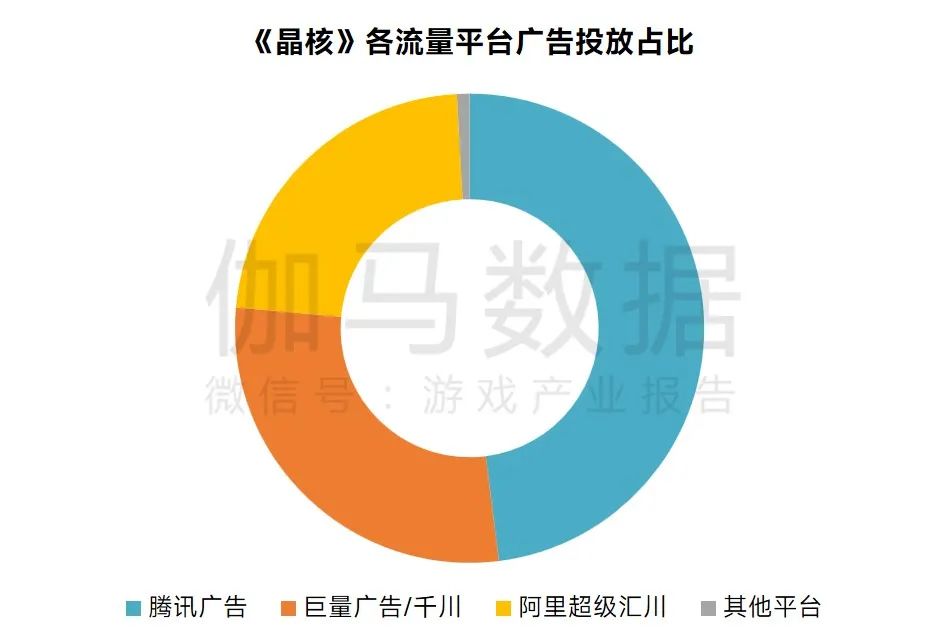

Data from AppGrowing and DataEye both show that Chaoxi Guangnian’s self-developed hit mobile game “Crystal Core” spent nearly half of its budget on Tencent advertising, even more than its own massive platform. Behind this is not only a manifestation of the easing of the relationship between Byte and Tencent, but also the helplessness of looking for quantity from the outside.

After the bankruptcy of Grand Narrative, game manufacturers need to be more down-to-earth. Quality, industrialization, and version numbers are all profoundly changing the game industry, and Evergreen Games has become the new darling. Today, the development cycle of a game has been extended to 2 or 3 years. Judging whether a category or a track will be popular after 3 years is no longer an answer that can be achieved by relying on resources.

Therefore, Ma Huateng will bluntly say that he “doesn’t believe in buying volume” and advocates restraint in the use of resources. He believes that abusing the platform and resources will put a filter on the product, making it difficult to see the direction.

DataEye Research Institute also found that since 2021, as the purchase cost has increased, the marketing efficiency (revenue/Internet traffic costs) of major manufacturers including Gigabyte, Perfect World, Century Huatong, and Sanqi Interactive Entertainment have shown a downward trend. .

The increase in reliance on purchase volume and the decrease in marketing efficiency are manifestations of the continuous involution of the industry.The game has gone from its original profit-making situation. Most of the revenue is contributed to channels and advertising platforms, leaving only 3 to 5 points of profit for ordinary publishers. If this continues, the days when the gaming industry will be reduced to food delivery, online ride-hailing, and relying on cheap labor to make a living are probably not far away.

The gaming industry has returned to a time when choice is more important than hard work. Even if you have a fortune, you still need to find the right direction. No matter how diligent you are, you cannot ignore the market.

The founder of Larian Studio, which was invested by Tencent in 2018, revealed that it had been on the verge of bankruptcy more than 10 times in the 27 years since its establishment. This year it finally launched the global hit “Baldur’s Gate 3”. Mimimi, which has been involved in RTT games all its life and is also an independent studio, was unable to sustain due to the size of the category market. After struggling for 15 years, it finally chose to close.

The same is true for the original intention, but it has a different ending.

Roll or not, the initiative is ultimately in your own hands. Super masterpieces, evergreen games, and moon landing projects are not suitable for everyone. Casual games and games that are not like games (interactive movies and television) are all options.

Reduce marketing, buy less, and spend more resources and attention on the product community. Games can be made in any era, even without a grand narrative.