[Game-Timespecialarticlenoreproductionwithoutauthorization!】

Game-Time report/A major event that has recently triggered discussions in China’s Internet industry is that the positions of the two giants ByteDance and Tencent seem to be exchanging.

According to Bloomberg, ByteDance’s full-year revenue in 2023 will reach US$120 billion, a year-on-year increase of 50%, surpassing Tencent’s US$86 billion; ByteDance’s EBITDA (earnings before interest, taxes, depreciation and amortization) is even higher It grew by more than 60% year-on-year to reach US$40 billion, also ranking ahead of Tencent.

Regarding the data thrown out by Bloomberg, ByteDance’s official account denied it, but did not give specific official figures.Considering that Bloomberg will not make lies out of nothing, it is an indisputable fact that ByteDance has been in a period of rapid growth in recent years. Amid the rapid growth of ByteDance, it is difficult to say that Tencent still has the upper hand.

Through the “filter” of being a gamer, Byte has put down its gaming business, which it has invested heavily in, but is now achieving its goal of surpassing BAT one by one. Tencent, which has gaming as one of its core businesses, once had a “stock king” Although it has a good reputation, like most game companies, it has fallen into the stagnant growth of the global game industry. This to some extent symbolizes the changes in the technology industry: the “golden age” of the game industry seems to be quietly passing away from us.

In the competition among giants, in the face of the unfavorable global game industry environment, gamers have tried their best, but Game-Time wants to say that gamers do their best, but should not rely on fate.

As the gaming industry’s flywheel turns slower

It is true that the existing scale of today’s game industry is still developed, but it is no longer the high-speed growth flywheel that everyone envied – the “2003 China Game Industry Report” shows that the size of China’s game market in 2003 was 1.32 billion yuan; 20 Years later, this figure has been refreshed to 302.9 billion – an increase of more than 200 times.

After the COVID-19 stay-at-home economy spurred a wave of growth, the growth of revenue and user numbers in the game market has slowed down rapidly, showing the characteristics of strong stock competition – it is more difficult for small and medium-sized teams to break through, and the labor market is becoming increasingly “involved”. These are all direct consequences of stagnant growth.

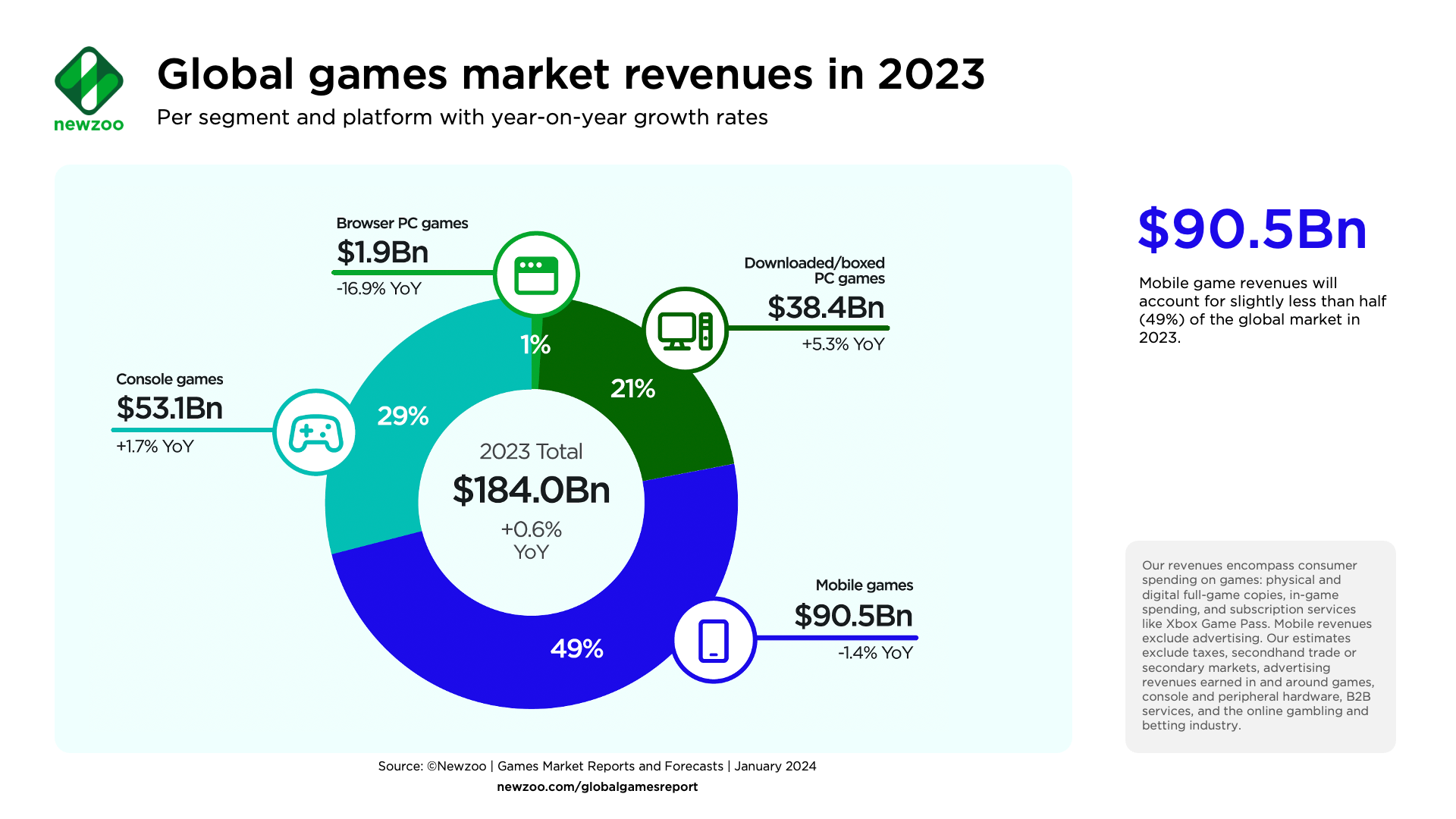

Judging from data from industry research institutions such as Newzoo, not only China’s domestic market, but also overseas markets are currently showing similar sideways trends. The number of layoffs in the global gaming industry exceeds 10,000, and changes such as project cancellations and company sell-offs are becoming more frequent. These phenomena all prove that the growth curve of the gaming industry is gradually declining.

Newzoo: Mobile game revenue will decline 1.4% in 2023

For Tencent, game revenue has always been an important pillar – the company’s history once accounted for more than 50% of revenue, and the average contribution ratio was about 30% – but now when Tencent lacks growth the most, the game business has not They failed to stand up and become the pillar supporting the new growth curve.

Whether we focus on Tencent’s ranking in the technology circle or the current overall situation of the industry, it is not difficult to see a major contradiction: the top priority right now is to return the gaming industry to growth.

But where is the path to growth? In the short, medium and long term, market growth points in three directions.

Where does short-term growth come from: Works speak for themselves, embrace business changes

A basic understanding that is often overlooked by us is that as a content-led industry, product quality and innovative experience have always been the driving force behind the continuous expansion of the game market.

For example, what we have seen in the console and PC markets is that despite the shrinkage of the global game market, acclaimed and popular products such as “Elden’s Ring”, “Baldur’s Gate 3” and “Pallu” are still being produced. The mobile game market also follows this rule, such as last year’s “Monopoly GO” and “Monopoly GO”.Royal Match“Nishuihan Mobile Game” and this year’s “Last War” both broke out under difficult market conditions, which proves the correctness of “content is king”.

Therefore, the key to unlocking growth in the short term does not lie elsewhere, but in the hands of various game companies – if there are more innovative games with high quality gameplay, adapt to the marketing environment, and reasonable cost structures, and can be welcomed by a large number of users, the emergence of games will attract more players. As more people become gamers, at least some gaming companies can resume growth.

But on the other hand, what the gaming industry currently lacks is strong medicine that can take effect quickly and boost morale.

Limited by the research and development cycle, it often takes several years to create a masterpiece, but changes in business models in the industry may bring rapid growth dividends.

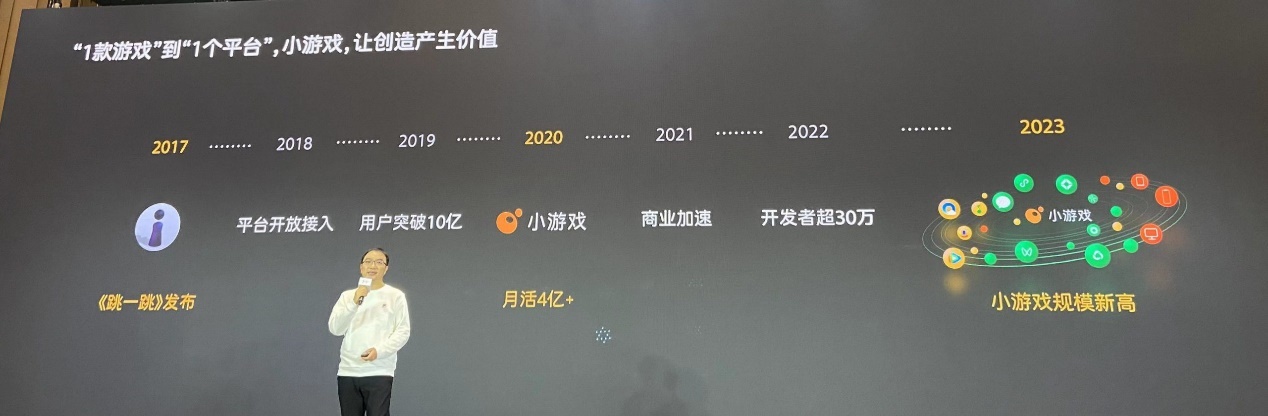

For example, the rapid rise of small games due to the development of technology, the establishment of new platforms and new business models is such a sector that can achieve miraculous results in the short term. Cloud games are also potential stocks in the future.From the perspective of small and medium-sized manufacturers, the market where the annual revenue of small games has grown by more than 50% year-on-year, the R&D threshold is not high, and the overlap with App paying users is only 11% has opened up new business possibilities for them. According to industry insiders, WeChat mini-games have already sold mini-game products with a cumulative turnover of tens of billions.

From the perspective of leading companies, Tencent currently occupies 65% of the total domestic game market. Tencent actually has nothing to do with the remaining 35%. Most of them are client game companies, volume purchase companies and small and medium-sized companies with special skills. As Tencent “unintentionally” opened up the small game battlefield, the giant finally found an effective entrance to the “35% market.”

Mini-games are similar in nature to stand-alone games – short life cycles and low turnover. This type of “pulse-type” game products are not suitable for giant companies with high labor costs and limited version numbers. However, as a platform, Tencent relies on the well-developed WeChat ecosystem and relies on the WeChat mini-game team of only a few dozen people to build infrastructure. Through Tencent advertising, WeChat payment, and in-app purchase sharing, Tencent is able to leverage it in one fell swoop. move a market size of tens of billions. The profit margins that can be gained from this can be imagined.

No wonder WeChat mini-games have recently become a competitive area of focus in the gaming industry, and have also attracted ByteDance to offer a 9:1 split.

Medium-term growth: rushing to “the other side of the sea”

Admittedly, although the mini-game market is booming, it remains to be seen whether it can become an incremental contributor. From the perspective of China’s game industry, the real “increment” will always be in overseas markets – taking Tencent as an example. This giant’s online game business revenue in 2023 will be 179.9 billion yuan, a year-on-year increase of 5.4%, and this is largely due to Driven by overseas markets – its overseas game revenue accounted for 30% for the first time.

“If you don’t go global, you’ll be out” is obviously a solid understanding within Tencent. In recent years, this major company has been continuously deploying the global market through overseas studio investment and acquisitions, and global distribution of domestic products. In addition to the main battlefield of mobile games, it also focuses on investing in the PC console market, trying to “re-create a Tencent” overseas.

Nowadays, the increase in the proportion of overseas revenue is undoubtedly a good news, but at present, before Tencent, NetEase, and more game companies can fully implement the globalization, there is still a period of climbing that is not easy to rise, especially for those who are unfamiliar with Chinese companies. of the console and PC markets.

Before that, the “timing” to find popular gameplay, the “patience” to make long-term bets, the “luck” to beat domestic and overseas competitors, and the “strength” to hone product quality, these four major elements will form Tencent’s future. Going to sea is a “difficulty”, and what awaits at the end of the pass will be the “True Sutra”.

Long-term outlook: ‘Tearing the roof off the game’

And is the overseas game market really growing? This may be true from the perspective of China’s gaming industry, but on a global level, the mobile gaming market is also an area of existing games – just competing overseas is more like jumping from a circle to a slightly larger “siege city” .

In overseas markets, game giants are trying subscription systems, UGC and other methods to expand the overall payment coverage of the game market. One observation is that, whether it is ByteDance, Pinduoduo, or Xiaohongshu, the success of none of these new-era Internet giants relies solely on customers in a single industry: they stand in the middle of a huge intersection, looking to passersby. By imposing tolls (advertising fees and trading commissions) on all industries and everyone, the roof will be lifted to achieve unimaginable growth.

With the goal of breaking through the ceiling, there is only one way before the game industry – to break the restrictions of the game industry and make games not only a place for entertainment, but also a place for consumption, work and study, in various industries and even ordinary people. Netizens can all contribute to game value and creativity. By then, even the concept of the game itself may need to be reinterpreted: Is it the metaverse? Or a “virtual world”? When gaming becomes a behemoth, it is destined not to be what we know today.

In this direction, pioneers like Roblox have been exploring. This UGC platform continues to promote the concept of the metaverse, attracting well-known brands outside the industry such as Nike and Vans, and laying out e-commerce payment capabilities, trying to build the Roblox world with hundreds of millions of monthly users into a marketing ecosystem that allows more brands to invest in it.

Roblox Nike Showroom

However, in Game-Time’s view, limited by Roblox’s own technology and expressiveness, its final effect cannot be called “ideal” after all. Even the current technological sum of the entire gaming industry is difficult to implement.

But in the engines of game companies, prototypes have already appeared: such as the father of “PlayerUnknown’s Battlegrounds”Brendan GreeneThe proposed vision of a “planet-level world”; the open-world gameplay “Oasis World” in Tencent’s “Peace Elite” that attracts real-life brands, and so on. There are also manufacturers like MiHoYo that take “a virtual world in which one billion people live” as their long-term development goal.

“Peace Elite” Oasis World gameplay

These lofty-minded game manufacturers have already held the ticket to the next era in their hands, and are just waiting for an opportunity to start – perhaps the explosion of brain-computer interfaces, perhapsAIGCHelp us double our content research and development capabilities. But looking at the long term, only long-term players in the gaming industry can turn this multiplication opportunity into reality.

Keep moving towards a better future and firmly believe that when the turning point comes, people’s efforts will not be let down – this is all we can do.